MARKET WATCH

Important Market Update From

INFORMA energy

A significant development could end reasonably priced natural gas and electricity prices after two and one half year historical lows. The impact of new federal requirements restricting emissions from coal-fired plants (the EPA’s “Cross-State Air Pollution Rule”) presents the risk of a major price spike for both commodities.

The impact of the new EPA rules is not limited to the 27 states to which they apply, making it imperative that all commercial and industrial customers review their energy budgets and hedging strategies for 2012.

Natural gas prices have been more than adequate to meet current power sector needs. The current market actually provides little in the way of predicting major price increases. Natural gas supply increases have kept prices at the Henry Hub (the benchmark for trading on the New York Mercantile Exchange) between $4.00 and $4.50 per dth ($0.44-$0.45/therm). Except for the hottest days this summer, electricity prices have also been moderat.e

The weather factor is the wild card. In fact, prices might have dipped lower if weather this past year had been closer to historical norms. Winters have been much colder for the past two years and summers have been off the charts by exceeding 1,000 cooling degree days for the first time for two consecutive summer. Since natural gas and electric prices trend together, the effect of extreme hot weather kept the amount of natural gas in underground storage more than 200 bcf below last year’s levels and briefly pushed Henry Hub prices above $4.50 per dth.

Without the pressure of the new EPA rules, growth in production of natural gas and with extreme weather conditions matching the past two years, we would very likely have still seen a steep decline in natural gas prices. However, next year we anticipate that we won’t see “business as usual” due to major restrictions on emissions from fossil –generating plants. The emission caps will be imposed in two phases; the first to take effect on January 1, 2012 with tighter restrictions on January 1, 2014.

We are strongly recommending that our clients lock in supply within the next 30-60 days. Clients with contracts should review existing agreements and consider entering into additional forward contracts to reduce exposure.

Copyright © 2008 - 2013 INFORMA energy, Inc. All Rights Reserved. Website maintained by: Arlene Alvira

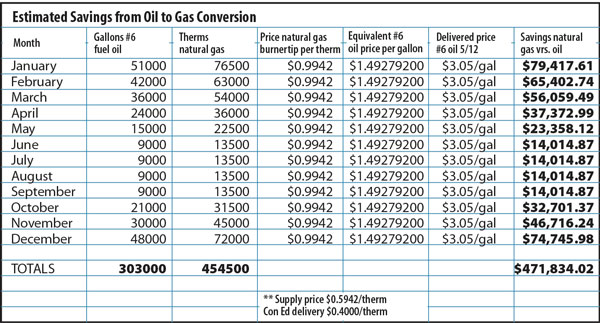

The comparison between # 6 fuel oil prices and natural gas prices shows a dramatic savings based on current market prices. A sample analysis at left provides an example how this conversion can add to the bottom line of your business.